Key Takeaways

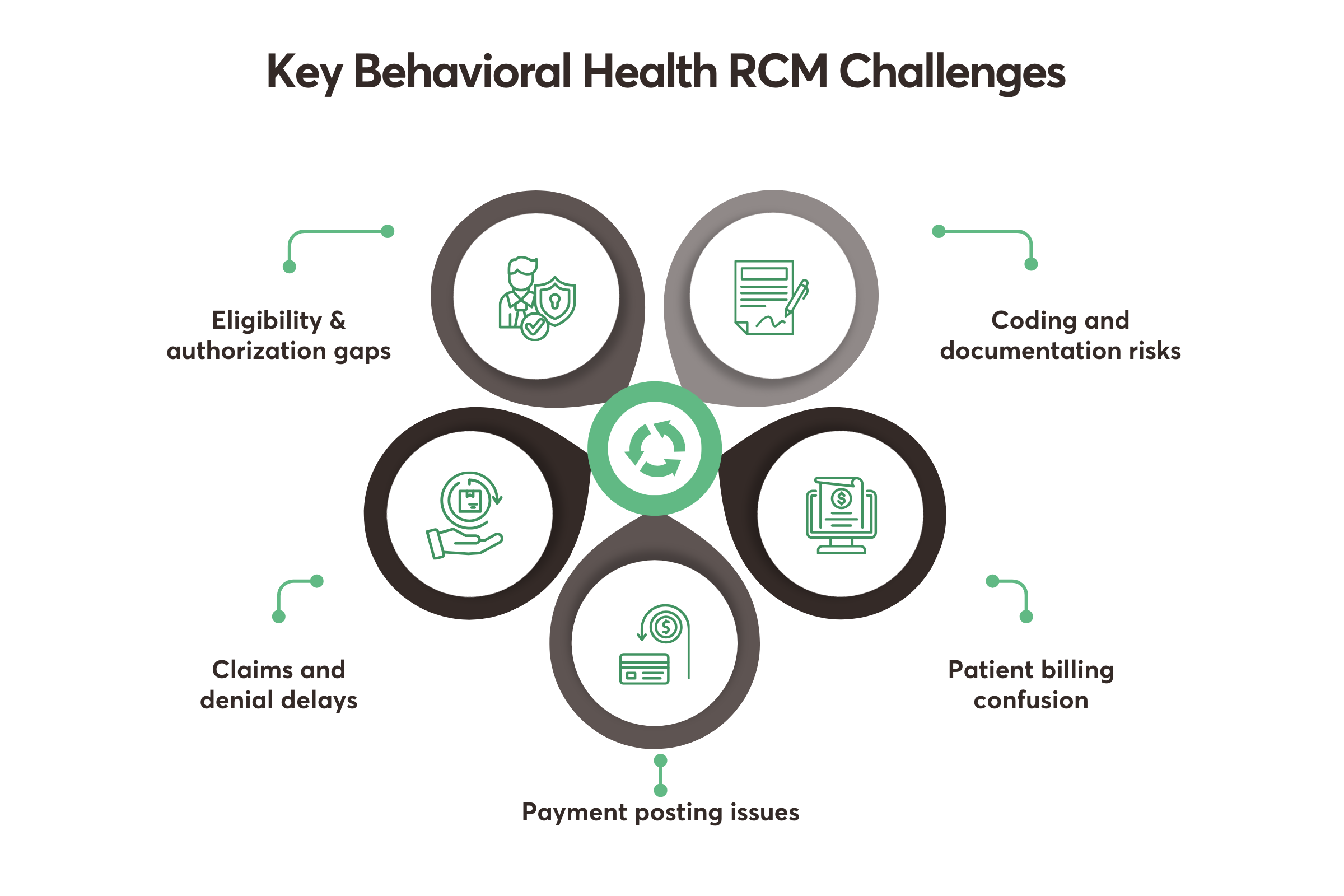

- Front End Gaps: Eligibility and authorizations break early, creating avoidable denials and delayed payments.

- Documentation Risk: Notes and treatment plans drive medical necessity, so small gaps trigger frequent payer rejections.

- Denial Pressure: Weak denial tracking hides patterns, leading to increased rework and slower cash flow across teams.

- Payment Posting: Manual reconciliation delays underpayment detection and reduces financial visibility for leadership decisions.

- Tech Advantage: Integrated platforms and automation streamline behavioral health revenue cycle management end to end.

Behavioral health RCM challenges continue to disrupt financial stability, operational efficiency, and patient access across modern behavioral healthcare organizations. Unlike traditional medical specialties, revenue cycles in behavioral health face strict documentation requirements, fragmented workflows, and inconsistent payer reimbursement structures.

These issues create compounding inefficiencies that affect cash flow, staff productivity, and long term sustainability. Many providers struggle not only with payer complexity, but also with outdated or disconnected systems that make eligibility checks, documentation, coding, and claims workflows difficult to standardize across teams. With the right behavioral healthcare solutions, organizations can modernize operations, reduce variability, and improve reimbursement outcomes.

What Makes Behavioral Health Revenue Cycle Management Complex?

Behavioral health revenue cycle management involves more than billing, extending across clinical documentation, payer rules, and patient engagement processes.

Providers must manage varied service models, session-based billing, and regulatory oversight while maintaining financial accuracy and compliance.

These structural complexities magnify small operational errors into significant revenue leakage risks.

Key Characteristics Increasing Complexity

- Session-based and time-based billing models

- Multiple care settings, including inpatient, outpatient, and virtual

- High documentation sensitivity is tied to medical necessity

- Frequent policy changes across commercial and government payers

Front End Revenue Cycle Challenges in Behavioral Health

Revenue issues often originate at the front end, before clinical care delivery even begins for patients.

Eligibility verification, benefits confirmation, and authorization workflows frequently remain manual, fragmented, or inconsistently applied across teams. Errors at this stage cascade downstream, increasing denials and delayed payments significantly.

Common Front-End Challenges

- Incomplete insurance eligibility verification

- Missed or incorrect prior authorizations

- Limited visibility into patient financial responsibility

- Inconsistent intake documentation quality

RCM Challenges Across Behavioral Health Operations

Documentation and Coding Barriers Unique to Behavioral Health

Behavioral health documentation requirements differ substantially from those for physical healthcare billing and coding workflows. Medical necessity standards rely heavily on clinical narratives, treatment plans, and progress notes rather than procedural clarity.

Small documentation gaps frequently trigger behavioral health claims denials during payer reviews.

Documentation Related Challenges

- Subjective clinical narratives increasing audit exposure

- Inconsistent treatment plan updates

- Complex CPT and modifier usage

- Varying payer specific documentation thresholds

Behavioral Health Claims Management Challenges in the Revenue Cycle

Behavioral health claims management requires precision across coding, payer rules, and submission timelines.

Many organizations still rely on disconnected systems that limit visibility into claim status and error trends. This fragmentation slows resolution and increases administrative burden across revenue teams.

Claims Submission Obstacles

- Inaccurate charge capture from clinical systems

- Delayed claim submission timelines

- Limited claim scrubbing capabilities

- Manual follow-up processes

Behavioral Health Claims Denials and Root Cause Challenges

Behavioral health claims denials remain one of the most significant financial drains for providers nationwide.

Denials often stem from preventable issues rather than clinical inappropriateness or lack of coverage. However, limited denial analytics prevent organizations from identifying systemic improvement opportunities.

Common Denial Drivers

- Missing or insufficient clinical documentation

- Authorization mismatches

- Coding inaccuracies

- Payer-specific policy misinterpretations

Quick Stat:

While denial rates vary by specialty, Optum’s analysis shows the average medical claim denial rate reached 12% in 2023, reinforcing the importance of strong front-end and denial management processes in behavioral health.

Medicaid Behavioral Health Billing Challenges in Revenue Cycle Operations

Medicaid behavioral health billing challenges introduce additional complexity due to state-specific rules and frequent policy updates. Coverage limitations, service caps, and evolving telehealth guidelines create billing uncertainty for providers serving vulnerable populations. Failure to stay current results in denied claims and delayed reimbursement cycles.

Medicaid Specific Pain Points

- State level policy variations

- Complex eligibility recertification processes

- Limited reimbursement rates

- Strict documentation audits

Quick Stat:

Denial pressure remains high across the industry. In Experian Health’s 2025 State of Claims survey, 41% of respondents said at least 1 in 10 claims is denied.

Behavioral Health Payment Posting and Reconciliation Issues

Behavioral health payment posting processes often suffer from delayed remittances and inconsistent payer adjustments. Manual reconciliation makes it difficult to identify underpayments, contractual variances, and missing reimbursements accurately.

These inefficiencies reduce transparency and slow financial reporting cycles.

Payment Posting Challenges

- Delayed explanation of benefits processing

- Manual adjustment handling

- Difficulty identifying payer underpayments

- Inconsistent write-off practices

Accounts Receivable and Collections Pressures

Behavioral health accounts receivable management requires proactive follow up across payer and patient balances. High deductible plans shift greater financial responsibility to patients, complicating collections strategies.

Without clear communication, patient satisfaction and revenue recovery both suffer.

AR Management Challenges

- Extended days in accounts receivable

- Limited patient payment transparency

- Inefficient follow-up workflows

- Resource constrained billing teams

Technology Gaps Driving Behavioral Health RCM Challenges

Many behavioral healthcare organizations rely on disconnected platforms for clinical, billing, and operational workflows. This fragmentation limits real time visibility and creates duplicate data entry across teams.

Modern behavioral healthcare software development focuses on reducing these operational silos.

Technology Related Challenges

- Limited integration between EHR and billing systems

- Manual data transfer errors

- Poor reporting and analytics capabilities

- Lack of real time operational insights

Role of Behavioral Healthcare Software Development

Purpose-built behavioral healthcare software development supports tighter integration between clinical and financial workflows. Unified platforms improve documentation accuracy, charge capture, and claims submission efficiency.

Through medical app development, providers can standardize data capture and reduce manual steps across revenue teams. Technology alignment enables revenue teams to focus on optimization rather than constant error correction.

Benefits of Tailored Platforms

- Integrated clinical and billing workflows

- Automated eligibility and authorization checks

- Centralized reporting dashboards

- Scalable infrastructure for growth

AI Development Solutions Supporting Revenue Optimization

AI development solutions increasingly support behavioral health revenue cycle management without replacing human decision making. Predictive analytics help identify denial risks, documentation gaps, and workflow inefficiencies earlier.

This proactive approach reduces downstream rework and accelerates reimbursement timelines.

AI-Driven Revenue Enhancements

- Denial risk prediction models

- Documentation completeness validation

- Intelligent claim prioritization

- Payment variance detection

Operational Impact on Care Delivery

Revenue cycle inefficiencies directly affect staffing stability, service availability, and patient access across behavioral health organizations. Delayed reimbursements strain budgets, limiting investments in care quality and innovation initiatives.

Sustainable operations depend on predictable and optimized revenue performance.

Operational consequences

- Staffing shortages and burnout

- Reduced program expansion capacity

- Delayed technology investments

- Compromised patient experience

Patient Experience and Financial Transparency Challenges

Patients increasingly expect clear communication regarding coverage, costs, and payment options before receiving behavioral health services.

Complex billing statements and delayed explanations erode trust and satisfaction levels.

Transparent revenue processes support stronger therapeutic relationships and improved retention.

Patient Facing Challenges

- Unclear financial responsibility estimates

- Confusing billing statements

- Limited digital payment options

- Delayed billing communication

Regulatory and Compliance Pressures

Behavioral health providers operate under heightened regulatory oversight related to privacy, documentation, and reimbursement integrity. Compliance failures expose organizations to audits, penalties, and reputational risks. Strong revenue governance reduces exposure while supporting operational confidence.

Compliance Related Challenges

- Evolving payer audit requirements

- Documentation retention standards

- Security and privacy regulations

- Reimbursement compliance expectations

Building a Sustainable Behavioral Health Revenue Strategy

Addressing behavioral health RCM challenges requires coordinated improvements across people, processes, and technology layers. Incremental improvements deliver compounding benefits when aligned with organizational goals.

Sustainable revenue performance supports both financial stability and clinical mission fulfillment.

Strategic Focus Areas

- Front-end workflow optimization

- Documentation standardization

- Claims and denial analytics

- Technology-driven integration

Future Outlook for Behavioral Health Revenue Cycles

Behavioral health revenue cycle management continues to evolve alongside value-based care and the expansion of digital health.

Organizations adopting integrated platforms and intelligent automation gain operational resilience. Future-ready providers balance financial rigor with patient-centered care delivery models.

Key Future Trends

- Increased use of predictive analytics

- Greater payer transparency requirements

- Expanded telebehavioral billing models

- Deeper clinical financial integration

Conclusion

Behavioral health RCM challenges stem from payer variability, strict documentation, and fragmented systems, often across diverse care settings. When eligibility, authorization, and coding break down, denials rise, cash flow slows, and burnout increases quickly nationwide.

Sustainable improvement comes from standardized workflows, denial analytics, clean claim practices, and clear financial communication for patients at scale.

EvinceDev, a USA-based custom healthcare software development company, delivers behavioral healthcare solutions through tailored platforms that unify clinical workflows and revenue cycle processes. With strong governance and the right technology foundation, providers can streamline operations, improve coordination, and expand reliable access to care.